December 1, 2025

FinOps Best Practices for Cloud Cost Optimization: Rightsizing, Tagging, Automation & More

By Shyam Kapdi

Improwised Technologies Pvt. Ltd.

Cloud computing changed the way businesses run their tech - and cover expenses - offering more flexibility but also sparking new budget challenges. Traditional approaches struggle to keep up with the fluctuating, uncertain nature of cloud-related costs.

This is where FinOps - financial operations, basically - steps in, connecting finance, tech, and teams so tool spending works better. It’s evolved steadily, adopting new approaches, sharper tools, yet adding strategies that help firms reduce waste while keeping eyes on targets - all without losing speed.

FinOps pops up as a new take on linking tech costs to actual outcomes - teams teaming up, chasing common targets rather than working solo.

What Is FinOps?

FinOps is about managing cloud costs through open communication, personal accountability, while encouraging collaboration - helping separate teams align without confusion.

FinOps isn’t about following a checklist - it shifts how teams operate day to day. Instead of guessing, engineers and money managers use real data to guide choices. When cloud use is shared clearly, people own their part more. Because info flows freely, things stay less confusing for everyone involved. Old-school IT budgets shift at a snail’s pace, yet these approaches move with real-time outcomes. Rather than sitting around for months, tweaks roll out on a steady beat. When companies expand their web operations, pieces like SaaS or AI plug right into the same framework. Collaboration feels lighter since changes spread fast.

- Blends money smarts, tech know-how, or real-world use to get more from the cloud.

- Replaces slow, static budgeting with dynamic, real-time visibility.

- Involves each person - whether engineer or boss - in owning costs.

- Speeds up choices by focusing on real results for the company.

Core Principles of FinOps (Based on the FinOps Foundation)

- Teams collaborate across Engineering, Finance, Ops, and Product

- Choices get shaped by up-to-date info that’s easy to reach

- Each person handles how they use the cloud

- FinOps focuses on what matters most to the business instead of only cutting expenses

- People welcome the cloud’s pay-as-you-go setup - some even prefer it

FinOps Framework: Principles and Lifecycle

The FinOps Framework gives clearer guidance while staying flexible. With support for a wide range of tech costs - like Cloud+, AI, or SaaS - it uses seven parts to work: Principles, Scopes, Personas, Phases, Maturity Model, Domains, and Capabilities. Instead of one-size-fits-all rules, it lets teams shape their approach based on real business demands. As cloud setups shift quickly, this setup keeps pace without losing focus

Key Principles of FinOps:

- Working together between groups matters a lot.

- Cloud choices link directly to how well a company does.

- Clearness with joint responsibility pushes for better results.

- Quick moves mix well with control - balance matters when things go fast, but rules still apply.

- Money numbers plus daily performance get checked.

- Each team handles its own cloud costs instead of relying on finance alone.

The Lifecycle Phases:

- Set up clear views plus team dashboards. Spread costs right while boosting reports.

- Trim expenses by spotting savings - use smaller setups, book deals ahead, grab discounts when available, or set tasks to run themselves.

- Run things by tracking money moves all the time, while applying clear rules and oversight along the way

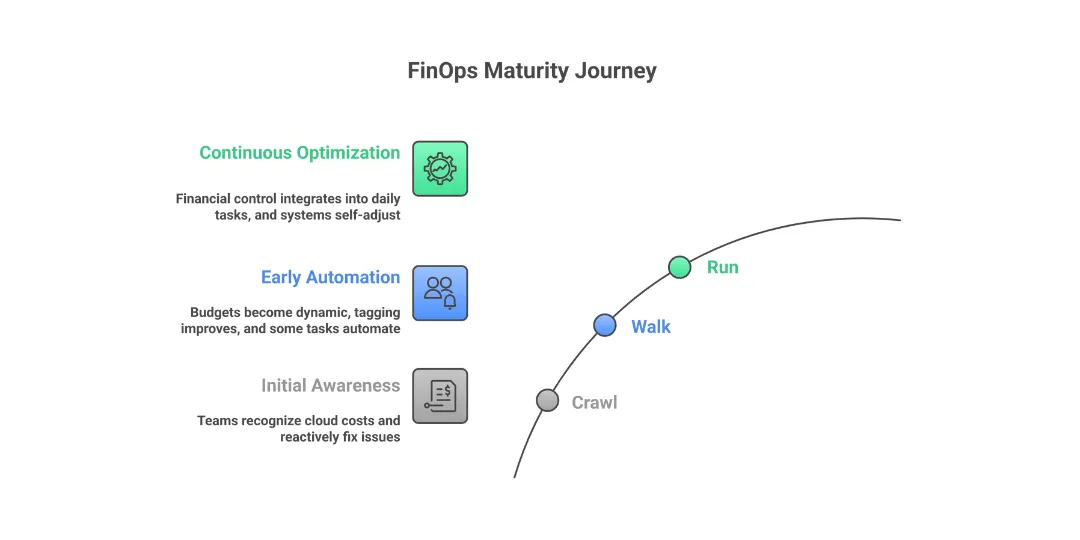

FinOps Maturity Model: Evolving from Awareness to Automation

The Framework now tracks progress using “Crawl, Walk, Run” instead of one single rating for every Scope and Capability. So rather than just ticking boxes, groups can see how far they’ve come - then focus on what’s missing. It turns growth into steps, not scores

Maturity Stages Explained:

- Crawl: Just knowing costs, fixing things after spending happens.

- Walk: Budgets that act fast, plus predictions - some tasks run themselves, resources labeled clearly using smart tags.

- Run: Financial control works right inside daily tasks, while smart systems keep things running smoothly through constant updates that adjust on their own.

Key Benefits of Higher Maturity:

- Accurate budgeting and predictable costs.

- Faster product delivery thanks to smoother financial governance.

- Cost decisions that closely align with commercial outcomes.

Benefits of Implementing FinOps in Your Organization

FinOps delivers measurable business benefits. With higher cloud visibility and accountability, organizations optimize spending - not just to save money, but to improve capability, agility, and speed.

-

Enhanced Cost Visibility: Clear insights empower teams to understand where cloud dollars are spent and why.

-

Cross-functional Collaboration: Bridging finance, DevOps, and product teams creates shared understanding.

-

Cost Optimization: Right-sizing, discount models, and automation reduce waste without sacrificing performance.

-

Business Agility: Accelerated delivery by removing financial bottlenecks and integrating cloud costs in decision-making.

Key FinOps Practices and Strategies

Assigning tags along with expenses creates accountability - this way, groups see their impact on budgets using chargeback or showback methods. Scaling resources ensures each cloud component runs efficiently, boosting output while cutting clutter; mix in reserved instances or spot deals to slash costs far below standard pay-per-use pricing. Active monitoring catches budget leaks early by setting alerts, running audits, and enforcing policies. When demand spikes, issues arise, or speed drops, automated tools step in quickly, adjusting settings in real time.

- Tagging & Cost Allocation: Accurate resource labeling enables precise chargebacks and budget control.

- Rightsizing: Regular analysis prevents overprovisioning and adapts the resource footprint to demand.

- Discount Pricing Models: Strategic adoption of reserved instances, savings plans, and spot markets.

- Governance Policies: Budget alerts, approval processes, and policy checks to manage cloud spend.

- Automation Tools: Implement automated scripts and platforms for cleanup, scaling, and anomaly detection.

- Continuous Optimization: Monitor and refine workloads based on real-time cost insights.

FinOps Tools and Technologies

As FinOps evolves, tech setups now mix cloud-cost tools with smart automation. Leading options provide a single view of spending, auto-apply labels, forecast trends, and identify unusual spikes. New advances help weave cost control into SaaS apps, containers, data pools, plus Kubernetes environments

Essential Capabilities in FinOps Tools

- Cost Allocation: Breaks down costs by provider, department, feature, or customer.

- Automated Tagging: Scales labeling of resources for easy tracking.

- Predictive Analytics: Flags anomalies, forecasts budgets, and recommends optimizations.

- AI Automation: Automatically rightsizes, decommissions, or pauses underused resources.

- Cloud-agnostic Integration: Supports AWS, Azure, GCP, and more in a single view.

Cultural and Organizational Challenges in Adopting FinOps

Getting FinOps right depends just as much on teams as it does on tools. Companies need to encourage teamwork across departments, tear down old barriers that hinder progress, and foster a culture where everyone feels accountable. Support from leaders matters - so does regular training - as do updates to workflows whenever the cloud changes

Common Organizational Challenges:

- Resistance to change and shared ownership.

- Inconsistent tagging and poor cost data hygiene.

- Difficulty in aligning culture, incentives, and processes.

- Need for ongoing training and community support.

Steps to Start Your FinOps Journey

Take it step by step when getting into FinOps - don’t rush. Look at your current situation, while also thinking about how developed your system already is. Choose specific tech zones to work on, such as cloud services or online software tools, rather than spreading yourself too thin from the start. Gather a small team that sets targets, makes guidelines, and shares knowledge with everyone else. Kick things off small - start with simple moves like steady labels or real-time updates before pushing ahead. Build slowly, tossing in sharper tools and self-running setups just once folks feel at ease.

Starting Steps:

- Assess maturity using the FinOps Framework.

- Define scopes according to critical technology domains.

- Establish a central FinOps team or champion.

- Launch foundational practices and shared tools.

- Scale and iterate with advanced automation and governance.

Conclusion: The Future of Financial Operations in Cloud Management

FinOps changes things - financial awareness walks beside tech growth, speeding up what businesses achieve. With common tools, hands-on approaches, and teamwork that stays strong, organizations turn cloud costs into an advantage. Jumping in once won’t cut it - progress comes step by step, bringing sharper views, better accountability, also long-term wins down the road.

By Shyam Kapdi

Improwised Technologies Pvt. Ltd.

By Shyam Kapdi

Improwised Technologies Pvt. Ltd.

By Shyam Kapdi

Improwised Technologies Pvt. Ltd.

Optimize Your Cloud. Cut Costs. Accelerate Performance.

Struggling with slow deployments and rising cloud costs?

Our tailored platform engineering solutions enhance efficiency, boost speed, and reduce expenses.